AUTHORS

PraveenKumar Radhakrishnan

Lead Manager Exponential Technologies

Head of Blockchain Practice @Bip xTech

Giulio Roscigno

Business Analyst @Bip

Energy & Industrial sector

On September 15th, the Ethereum Network completed the first phase of its five-step roadmap towards being one of the few public blockchains that are scalable, decentralized and secure simultaneously. This crucial step, the Merge, saw the network switch from the energy-hungry, slow and expensive consensus mechanism – Proof-of-Work (PoW) to the more scalable, eco-friendly and faster Proof-of-Stake (PoS). Heralding a watershed moment for the blockchain industry, this step potentially opens the door to increased adoption of public blockchains by enterprises which have historically favored the private variant mainly for stability of transaction costs, throughput and speed, among other reasons.

This article strives to provide a snapshot of the effects the Merge. But before that, a quick review of Ethereum and the important role it plays in our progress towards a more decentralized future.

Ethereum – a review

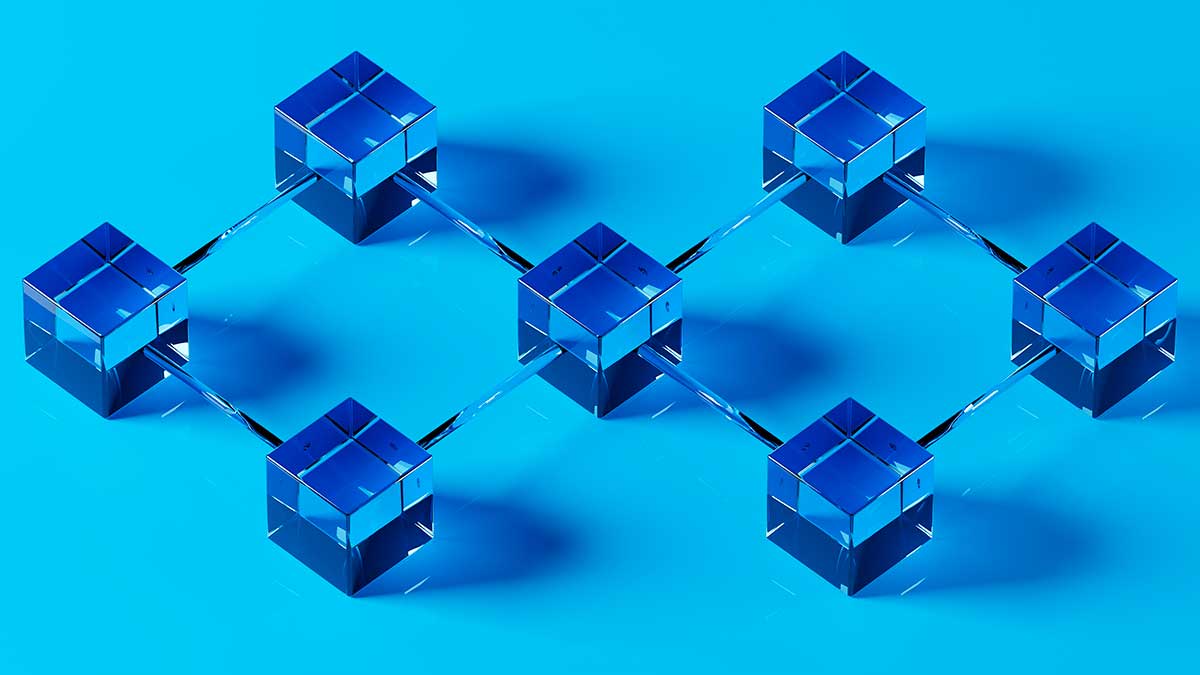

A few years after the birth of the paradigm-shifting Bitcoin network, Ethereum was created in response to the need to be able to program blockchains. Achieved via Smart Contracts (self-automating codified business logic that listens to events and executes its program), this feature opened up multiple venues for blockchain application which was earlier focused only on disrupting the world of finance. Since then, the network has grown to become the largest programmable blockchain, synthesizable as a distributed computer running on a decentralized peer-to-peer network supporting Initial Coin Offerings (ICOs), Decentralized Applications (dApps), digital assets trading, and even Decentralized Autonomous Organizations (DAOs).

The following are a few facts to underline the protocol’s magnitude:

- It ranks as the second largest protocol by market capitalization $158B (as of 22/09/2022)

- More than 95% of Non-fungible Tokens (NFT) are sold on various marketplaces built on Ethereum

- More than 70% of Decentralized Finance (DeFi) TVL (Total Value Locked) is found in its ecosystem

- To date, 10X more developers prefer Ethereum compared to other blockchains, while 20-25% of new developers entering the Web 3.0 space consistently choose Ethereum (Electric Capital, Developer Report, January – December 2021)

Despite its potential and successful run, the Ethereum network has faced several issues such as high transaction fees and low throughputs owing to network congestion, the threat of centralization owing to increasing complexity of the PoW algorithm and energy costs (associated with mining), price volatility, market sentiments, and last but not least, the various cyber attacks on applications built on the network that have inadvertently, yet misguidedly, cast Ethereum in a bad light.

The blockchain trilemma: the technical problems mentioned earlier are together dubbed the blockchain trilemma (especially relevant to networks built on PoW). Essentially, the problem states that decentralized networks cannot address all three crucial aspects simultaneously – scalability (throughput and cost), decentralization and security. For instance, if a network focusing on security tends to increase the complexity of the cryptographic ‘game’ miners solve, it would lead to higher power consumption, lower transaction speeds and threat of centralization when miners start pooling their resources together to make their work profitable.

Improving scalability and lowering transaction fees while boosting efficiency without sacrificing security is the primary goal of the Ethereum development team; the Merge marks a milestone in ultimately achieving this.

The merge: Sustainability, Security, Scalability

Ethereum’s Merge is an upgrade that will replace the current consensus mechanism – PoW – with PoS. So why call this upgrade a ‘merge’?

Ethereum’s shift to a PoS consensus has been a part of the network’s roadmap since nearly the beginning. And the catalyst to making this happen: Beacon Chain – an independent PoS blockchain developed by the Ethereum foundation. This PoS chain, which was launched in December 2020, existed in parallel to, and in no way affected, the original Ethereum network. Its reason to exist was very simple: lay the groundwork and test the PoS consensus mechanism before adopting it to the original Ethereum network. It did not field any transactions between peers. It did not have any of the Ethereum Virtual Machine (EVM) components and smart contacts functionalities. All that still existed and happened in the original Ethereum network.

The Merge refers to the original Ethereum network merging with the separate proof-of-stake blockchain called the Beacon Chain. They now exist as one chain which contains the EVM components and smart-contract functionalities – all running on a PoS consensus.

To better grasp the concept of this upgrade, consider this analogy: the Ethereum network is a computer running on a fictional operating system (OS) – X. It permits the user to run applications with varying complexities such as a simple notepad to a complex mathematical simulator. Now imagine that OS X is slow, but secure. Ethereum’s shift from PoW to PoS is akin to upgrading the aforementioned computer’s OS X to a new, faster OS Y without compromising on security.

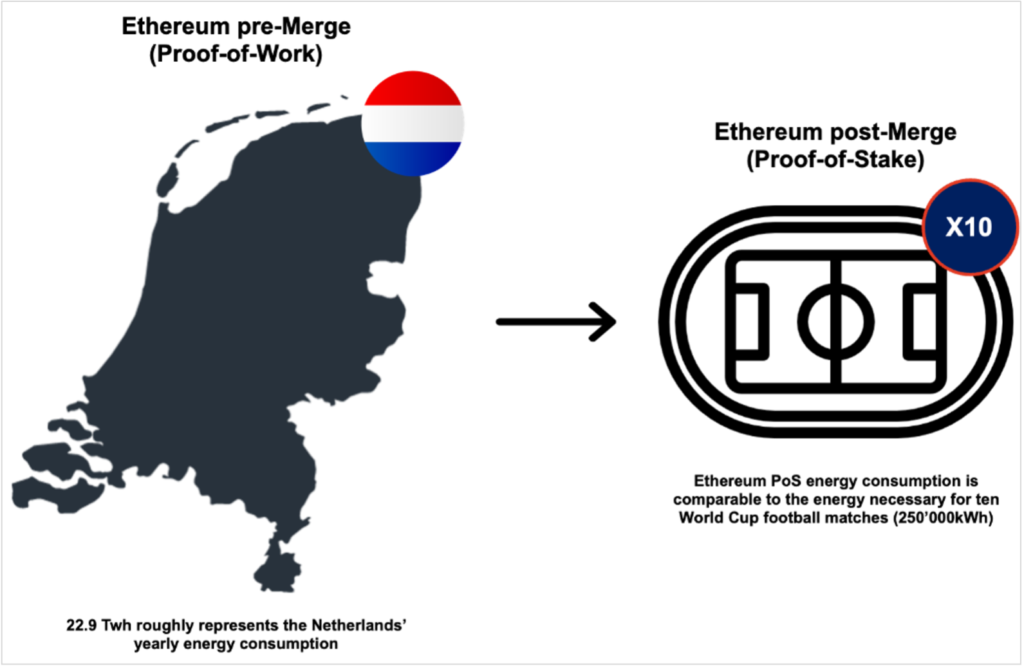

A literature survey shows that, post-merge, Ethereum has become a more sustainable network. After the upgrade, the energy consumption of the network has reportedly shrunk by 99.95% [Consensys, Ethereum.org, Nasdaq, CCRI Ethereum report]. This was one of the most highly anticipated benefits of shifting to PoS. But what is it that makes PoS so much more energy-friendly compared to PoW.

ETHEREUM NETWORK POWER CONSUMPTION: PRE- AND POST-MERGE

Proof-of-Stake consumes less energy than Proof-of-Work because, rather than requiring computational power to solve a mathematical riddle, it allocates the right to validate transactions across different validators based on the percentage of tokens locked by each validator. The fundamental reasoning is that with having their value locked in the network, these actors will not be prone to malicious acts which will penalize them by slashing (burning; destroying) their staked ETH. The hardware requirements of many proof-of-stake systems are equivalent to average laptops on today’s market. This eliminates the prerequisite of investing in expensive, cumbersome mining rigs required to participate in PoW networks.

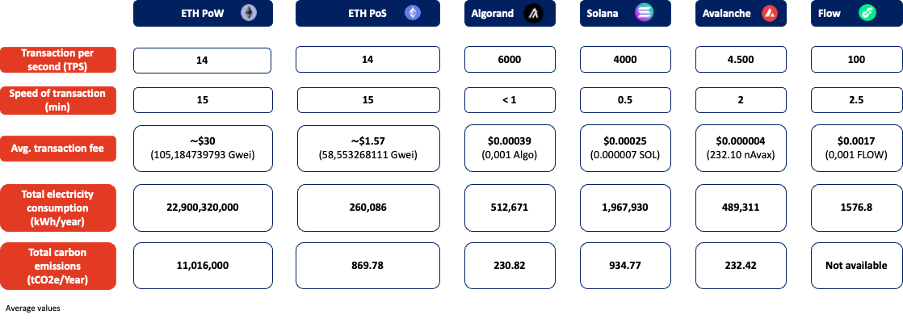

Ethereum’s Merge could not have come at a more opportune moment. With Sustainability Development Goals (SDG) and Environmental, social, and corporate governance (ESG) adoption trending across the globe, blockchain is positioning itself to be the technology that adds an element of trust between enterprises, institutions and consumers thanks to its immutability, transparency, ubiquity and inclusivity. But the other side of the coin often raises the question: is blockchain technology sustainable in itself to effectively host ESG applications? Does the technology practice what it preaches? Many new networks arose (namely Algorand, Solana, Flow to name a few) which have positioned themselves to be carbon-neutral blockchains (or at the very least, eco-friendly) compared to the two veterans: Bitcoin and Ethereum. Until now. Ethereum’s Merge has given it the edge to become the favored blockchain once again, with enterprises and even startups and scale-ups developing on the network in a bid to attract impact investors and sustainability-oriented corporations.

While later phases of the Ethereum roadmap will focus on increasing security without sacrificing the energy advantage gained by shifting to the PoS network, this consensus mechanism indirectly achieves more security, with respect to PoW, thanks to its decentralization and the consequent increase in network participation. With more nodes in the network, it will require increasingly more effort to execute a 51% attack. If determined malicious actors find a way around this, they will have to face the problem of slashing wherein the attacker will have to keep injecting ETH to substitute the burnt stake to sustain the attack. Some estimates report that hacking a PoS network will cost 10X-20X more than a PoW network.

About a year ago, the average cost of a transaction was on average $30 (gas fee: 92,54Gwei). Today, it is 1.57 USD (gas fee: 73,78Gwei), a -96% reduction in USD value (-20.27% in Gwei). However, given Ethereum’s roadmap, this fall is more attributable to the current Crypto Winter, which affects both the dollar value of ETH and the traffic on the network, the latter lowering the dynamic gas fee, than to the Merge. Despite this update being a turning point for Ethereum, it still is only a pivotal threshold in achieving greater network scalability in terms of increased transaction throughputs and reduced transaction fees.

Cost of a transaction: Perhaps it is too early to tell, but it should be noted that even if during the final stages of the roadmap the transaction costs are brought under control, there is always the element of price volatility – the fluctuation in the dollar value of the ether caused by speculation. Some new-gen blockchains like Algorand battle this fluctuation by fixing their transaction fee in native crypto as 0.001 Algo. This helps in mitigating some of the volatility. It remains to be seen whether Ethereum’s roadmap has some similar plan which could greatly limit the price fluctuation and make the network even more appealing to enterprise adoption and to start cannibalizing start-ups and developers away from the so called ‘Ethereum Killers’.

Ethereum’s inability to scale in the past has resulted in the creation of so-called ‘Ethereum killers’: smart contract-enabled blockchains with a PoS consensus mechanism and low transaction fees that have become increasingly more favored. The following table compares some of the major blockchains (we limit ourselves to public blockchains) to study Ethereum’s positioning pre- and post-merge across key technical dimensions:

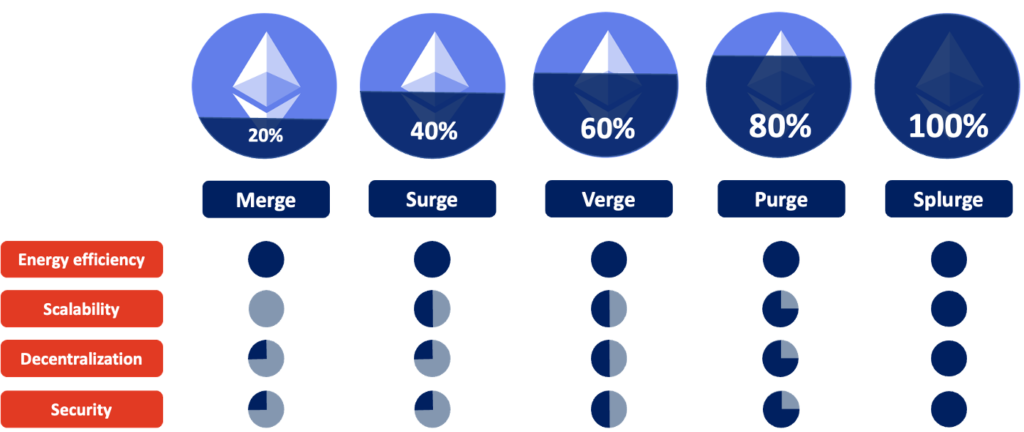

Beyond the merge

As mentioned earlier, the Ethereum roadmap has four important stages beyond the Merge. The next major update after the Merge will be the Surge (2023, Ethereum foundation). Here, the network will introduce sharding. Sharding is a technology which splits the data processing responsibility between many nodes, allowing for parallel transactions, storing, and processing of information. This leads to higher transaction throughput and potentially lower transaction fees as well.

The next update, the Verge, will focus on further increasing the scalability of the network and its decentralization by reducing the machine-stored data validators needed to run operations. Subsequently, the Purge will reduce the hardware requirements leading to more decentralization and inclusivity (essentially lowering the barrier to entry for validators) and streamline storage for validators by eliminating historical data. Finally, the Splurge will fine-tune the network.

We plan to keep you posted with a series of articles on Ethereum’s roadmap as and when they hit the milestones.

Is Ethereum relevant for business again?

Over 19M ETH (~12% of the total supply) has been staked to secure the Ethereum Network and generate rewards for over 418,500 validators (with a 5.28% APR). However, the real question on people’s minds is how it impacts businesses.

The biggest impact in the crypto world will be felt by ETH miners, since they will essentially no longer have a reason to exist post-merge. To continue, they will have to stake 32 ETH to become a block validator. Developers maintaining decentralized applications (dApps) developed in the original network will have to watch out for the changes in block structure, slot/block timing, opcode changes, safe head and finalized block timings. The updated Block Timing has a positive impact on user experience since post-merge, it is fixed at 12 seconds (compared to the range of a few seconds to one minute pre-merge). Overall, however, the merge is minimally disruptive to anyone currently running applications on the Ethereum network.

Despite the absence of significant upgrades in terms of the network’s scalability, for which we will have to wait till the Verge (2023), we identified two macro corporate users that could benefit from the Merge: institutional investors (ex: Fidelity Digital Assets) and infrastructure-focused players (Blockdaemon). For institutional investors, the shift from PoW to PoS offers a new investment vehicle – ETH staking yields. These yields will become to the crypto industry a “risk-free rate”, as the Treasury yield is to traditional finance. Indirectly, the Merge offers another investment opportunity to these players in the form of ESG compliant projects (read: impact investing) enabled by a blockchain technology that is eco-friendly (or at the least consumes a fraction of the energy compared to its original version). The same ‘ESG-compliance’ of the Ethereum Network post-merge could also pave the way or increased institutional investment in ETHER (ETH) – the cryptocurrency – itself.

Infrastructure-focused players too could potentially see an increase in their business from higher demand expected in the blockchain-as-a-service sector (39.50% CAGR) for the same aforementioned reason and the wider entrance of corporations in the Defi environment.

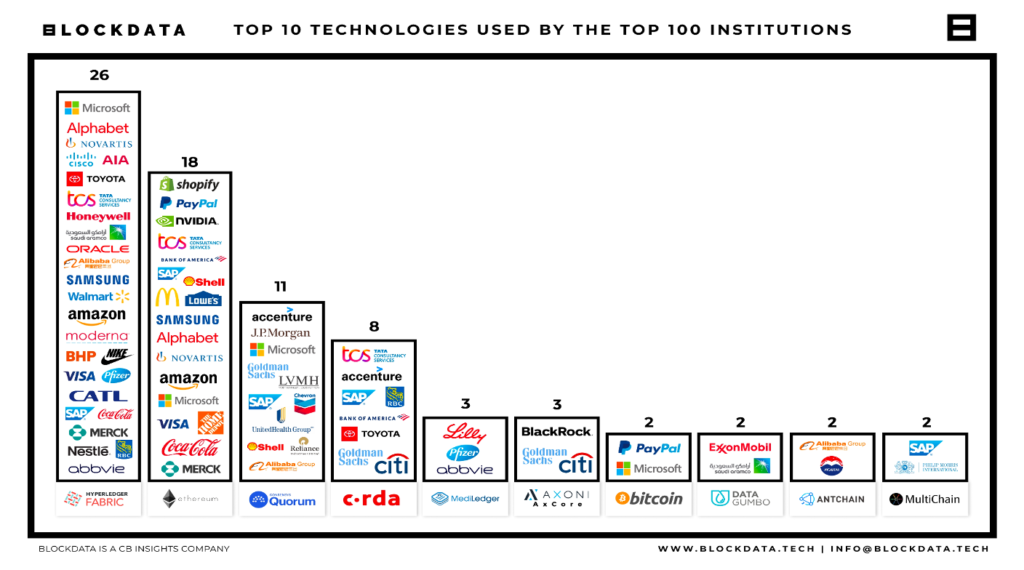

Since the advent of Ethereum, blockchain has found applications in many sectors enabling and reinforcing many use-cases. Despite the mixed sentiments in the market about the real need of decentralized technology and the value it adds (a key factor to keep in mind when researching the market is the changing demographics who are looking for more disintermediation, transparency and trust) it is clear that businesses should stop taking this technology for granted and start experimenting with it, if not building blockchain-related capabilities. Ceteris Paribus, often less clear is the choice of the right blockchain network. Choosing the most suitable one based on both business and technical requirements is key to the success of the project. This choice isn’t easy given the multitude of options in the smart contracts-enabled network panorama. While it is important to make this analysis on a case-by-case by basis, it is clear that Ethereum, thanks to the Merge, is once again in the race.

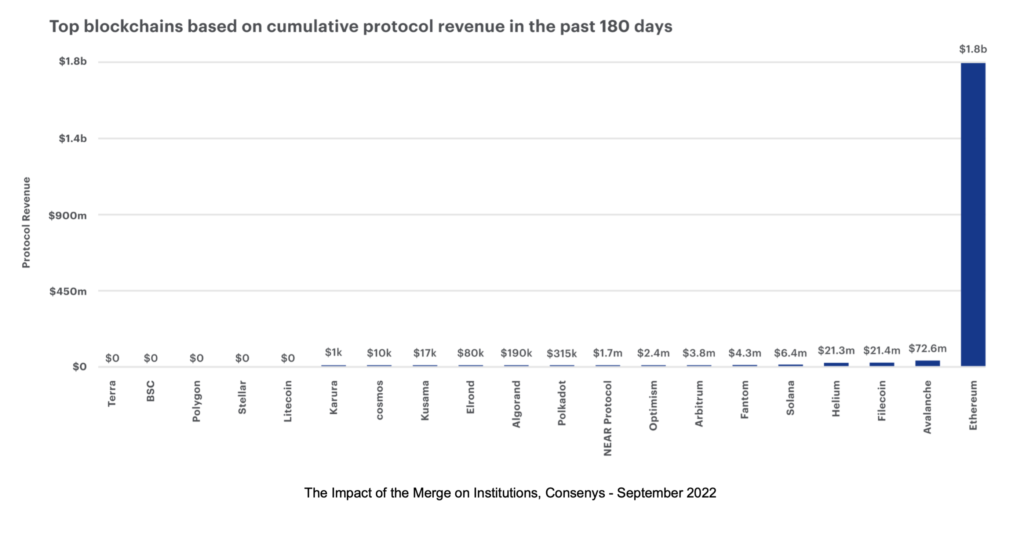

One of the more financial dimensions companies could analyze to determine whether a given network is reliable is the profitability and economical sustainability. A robust metric used for this is Protocol Revenue: the algebraic sum of the protocol’s transaction fee earnings and the costs for securing the network. Currently, nearly every blockchain spends more money on securing its network than it cashes in. As a recent Consenys report highlights, since mid-March 2022, ETH has generated $1.8B in protocol revenue, greatly surpassing the other top 20 blockchains by market capitalization. To underline the difference in protocol revenue between Ethereum and the other existing blockchains, Avalanche (AVAX), the second most successful blockchain when looking at Protocol Revenue, only generated $72.6M in the same period.

Ethereum has demonstrated that it is capable of radically improving itself, evolving towards the needs of institutional investors and businesses. Regarding the protocol’s scalability, we see short and medium-term solutions. Polygon, the most relevant Layer-2 solution by market capitalization ($6.602B) focused on constantly improving Buterin’s L1, has recently presented Polygon zkEVM: a construct that solves Ethereum’s scalability issues through enabling mass-transfer processing to occur in a single transaction that is fully EVM compatible, dramatically improving the transactions per second (TPS) while also lowering fees. While waiting for the Verge upgrade, Layer-2 will offer businesses the opportunity to develop and experiment with solutions in a low transaction fees environment compared to Ethereum and with the possibility to add privacy layers. Even after sharding deployment, L2s and zk technology will be beneficial, going hand in hand with the base protocol development and evolution. We had proof of this symbiotic relationship with the recent tweet by Polygon which, thanks to Ethereum’s merge, is now able to reduce its carbon footprint by 60.000 tonnes.

Zero-knowledge (zk) proof is a cryptographic method that allows an individual to prove that a statement is true without conveying any additional information – Ethereum.org.

In the medium-run, sharding will increase scalability by working with Layer-2 rollups to split the handling of the data over the entire network. This technology will also reduce network congestion and increase transactions per second, making Ethereum the most adopted blockchain globally and lowering transaction fees once and for all. After the Surge and the Verge implementation, Ethereum will potentially increase its TPS from 15 100,000.

Final considerations

We are at the precipice of a disruptive evolution comparable to that created by the internet in the 90s: blockchain offers multiple opportunities to innovate business and operational models. Companies should invest in this technology, experimenting with new services and applications for their respective industries. Investing in blockchain can reduce companies’ costs by eliminating intermediaries in a trusted environment and offer customers new products and services. 81 of the top 100 firms in terms of market capitalization are heavily investing in blockchain technology: 65 are actively developing blockchain solutions, 16 are in a research phase, and 39 are building on Ethereum. History shows that smarter and more innovative companies replace those that do not quickly adapt to transformations regardless of their dimensions and market share, and blockchain, especially the philosophy behind the technology, is a paradigm-shifter.

What do we do @Bip?

Bip is a leading management consulting firm with an increasing global footprint. Founded in 2003, Bip now employs over 4,000 professionals who provide management consulting and business integration services to support companies in researching and adopting disruptive and innovative technologies. The key to Bip’s success is providing excellent service with an ethical and loyal approach while providing innovative solutions to traditional problems. Today Bip exports professional services, operating abroad for a growing number of international clients in the United Kingdom, Spain, Turkey, Brazil, Belgium, Switzerland, United States, United Arab Emirates, Chile, and Colombia.

xTech is a center of excellence of the Bip Group with a dedicated Blockchain Practice. Combining xTech’s technical expertise with Bip’s industry and management consulting expertise, we have delivered important blockchain projects ranging from agri-food track & trace to proof-of-X certification, decentralized platforms for trading tokenized financial instruments and advisory in various sectors leveraging our expertise in both public and private blockchain.

We are, as always, alongside our customers to help them seize the opportunities offered by Blockchain and Web 3.0 in general. By virtue of our strong skills in IoT, Artificial Intelligence, Cloud, 5G, Extended Reality (AR, VR, Metaverse) – technologies that create synergies with blockchain – we are able to provide our clients end-to-end consulting services (advisory to development and maintenance of applications) of holistic solutions.

To request further information about our end-to-end offerings or to have a conversation with one of our experts, simply send an email to [email protected] with the subject “Blockchain”, and we will get in touch with you immediately.

Bibliography

- https://coinshares.com/research/ethereum-1million-tsp

- https://coinshares.com/research/compromises-and-benefits-ethereum-proof-of-stake-network

- https://polygon.technology/solutions/polygon-zkevm

- https://blog.polygon.technology/the-future-is-now-for-ethereum-scaling-introducing-polygon-zkevm/

- https://blog.polygon.technology/polygon-zkevm-within-vitaliks-framework-gaining-clarity-and-looking-ahead/

- https://ethereum.org/en/upgrades/sharding/

- https://cointelegraph.com/news/what-the-ethereum-merge-means-for-the-blockchain-s-layer-2-solutions

- https://www.blockdata.tech/blog/general/81-of-the-top-100-public-companies-are-using-blockchain-technology

- https://pages.consensys.net/impact-of-the-merge-on-institutions-insight-report-sept-2022

- https://blockworks.co/the-merge-will-not-lower-ethereum-transaction-fees/

- https://content.ftserussell.com/sites/default/files/education_proof_of_stake_paper_v6_0.pdf

- https://blockworks.co/fixed-income-hungry-institutions-next-play-is-likely-ether/

- https://blockdaemon.com/blog/navigating-the-importance-of-reliable-blockchain-infrastructure/

- https://www.globenewswire.com/news-release/2021/11/26/2341352/0/en/Blockchain-as-a-Service-Market-Size-Gross-Margin-Trends-Future-Demand-Analysis-by-Top-Leading-Players-and-Forecast-till-2027-Fortune-Business-Insights.html

- https://www.grandviewresearch.com/industry-analysis/blockchain-technology-market